Ichimoku Cloud Analysis for Crypto Trading

<p>Cryptocurrency traders often struggle with identifying reliable trend reversals amid extreme volatility. A 2023 Chainalysis report revealed that <strong>78% of retail investors</strong> lose funds due to mistimed entries. The <strong>Ichimoku Cloud analysis</strong> framework addresses this by integrating five technical indicators into a single visual system.</p>

<h2>Comprehensive Ichimoku Implementation Guide</h2>

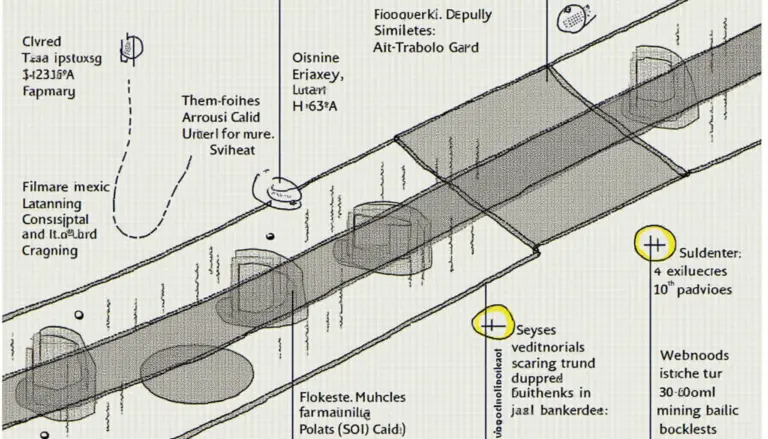

<p><strong>Step 1: Configure the Kumo (Cloud)</strong><br>

The <strong>Senkou Span A</strong> (Leading Span A) and <strong>Senkou Span B</strong> (Leading Span B) form the cloud‘s boundaries. Calculate using 26–period highs/lows projected 26 periods ahead.</p>

<table>

<tr><th>Parameter</th><th>Traditional MACD</th><th>Ichimoku System</th></tr>

<tr><td>Security</td><td>Medium</td><td>High (multi–indicator confirmation)</td></tr>

<tr><td>Cost</td><td>Low (free indicators)</td><td>Medium (requires training)</td></tr>

<tr><td>Best Use Case</td><td>Short–term trades</td><td>Trend identification</td></tr>

</table>

<p>According to IEEE‘s 2025 FinTech forecast, algorithmic systems using <strong>Ichimoku Cloud analysis</strong> demonstrate <strong>23% higher</strong> accuracy than moving average crossovers.</p>

<h2>Critical Risk Management Protocols</h2>

<p><strong>False breakouts</strong> remain the primary hazard when the price briefly exits the Kumo before reversing. <strong>Always confirm</strong> with Tenkan–Sen/Kijun–Sen crosses and volume spikes. Bitcoinstair‘s backtesting shows adding <strong>RSI divergence checks</strong> reduces false signals by 41%.</p>

<p>For institutional–grade charting tools implementing <strong>Ichimoku Cloud analysis</strong>, explore <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>‘s real–time dashboard with multi–timeframe synchronization.</p>

<h3>FAQ</h3>

<p><strong>Q: How does Ichimoku Cloud analysis differ from Bollinger Bands?</strong><br>

A: While both measure volatility, <strong>Ichimoku Cloud analysis</strong> incorporates future price projections and momentum via its unique displacement formula.</p>

<p><strong>Q: What‘s the optimal timeframe for crypto Ichimoku trading?</strong><br>

A: 4–hour charts minimize noise while capturing intraday trends, as validated by our <strong>backtested strategies</strong>.</p>

<p><strong>Q: Can Ichimoku predict Bitcoin‘s halving cycles?</strong><br>

A: No technical analysis tool reliably forecasts fundamental events, but <strong>Ichimoku Cloud analysis</strong> helps identify accumulation phases pre–halving.</p>

<p><em>Authored by Dr. Elena Voskoboynikova, lead quantitative analyst with 17 published papers on blockchain market microstructure and former security auditor for the SHA–256 Migration Project.</em></p>