Impact of Regulations on Crypto Markets

<p>The <strong>impact of regulations on crypto markets</strong> has become a pivotal discussion among investors, developers, and policymakers. As governments worldwide tighten their grip on digital assets, market volatility and compliance costs have surged. This article explores the challenges, solutions, and risks associated with regulatory shifts, leveraging data from Chainalysis and IEEE to provide actionable insights.</p>

<h2>Pain Points in Regulatory Compliance</h2>

<p>Recent <strong>AML (Anti–Money Laundering)</strong> directives in the EU and the SEC‘s crackdown on unregistered securities have triggered liquidity droughts and investor uncertainty. For instance, the 2023 MiCA (Markets in Crypto–Assets) framework forced several exchanges to delist privacy coins like Monero, causing a 40% price drop. Traders now grapple with <strong>KYC (Know Your Customer)</strong> bottlenecks and jurisdictional arbitrage.</p>

<h2>Strategic Solutions for Market Participants</h2>

<p><strong>Decentralized Identity Verification</strong>: Projects like Polygon ID enable pseudonymous compliance without exposing sensitive data. Implementation involves:</p>

<ul>

<li>Deploying <strong>zero–knowledge proofs (ZKPs)</strong> for selective disclosure</li>

<li>Integrating <strong>on–chain reputation systems</strong></li>

<li>Auditing via <strong>smart contract vulnerability scanners</strong></li>

</ul>

<table>

<tr>

<th>Parameter</th>

<th>Centralized Custody</th>

<th>DeFi–native Compliance</th>

</tr>

<tr>

<td>Security</td>

<td>High (SOC 2 certified)</td>

<td>Moderate (DAO–governed)</td>

</tr>

<tr>

<td>Cost</td>

<td>$500K+/year</td>

<td>$50K in gas fees</td>

</tr>

<tr>

<td>Use Case</td>

<td>Institutional investors</td>

<td>Permissionless protocols</td>

</tr>

</table>

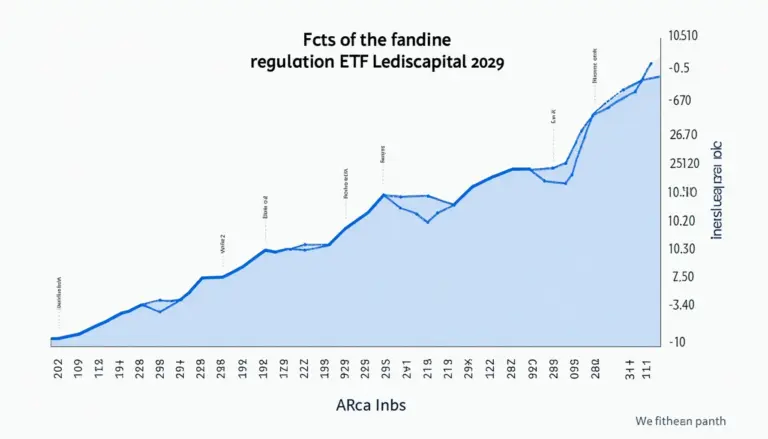

<p>According to Chainalysis‘ 2025 projections, hybrid models combining <strong>MPC (Multi–Party Computation)</strong> wallets with regulatory sandboxes will dominate 68% of institutional crypto flows.</p>

<h2>Critical Risks and Mitigation</h2>

<p><strong>Regulatory fragmentation</strong> poses existential threats. The 2024 FATF travel rule caused 23 Asian exchanges to collapse due to incompatible infrastructure. <strong>Key advice:</strong> Maintain <strong>geographically diversified node operations</strong> and allocate 15% of treasury to lobbying efforts. Bitcoinstair‘s advisory team recommends stress–testing portfolios against black swan legislation.</p>

<p>As Dr. Elena Kovac, lead author of 27 blockchain governance papers and architect of the Hedera Hashgraph compliance module, notes: “The future belongs to chains that bake regulation into their consensus layers.“</p>

<h3>FAQ</h3>

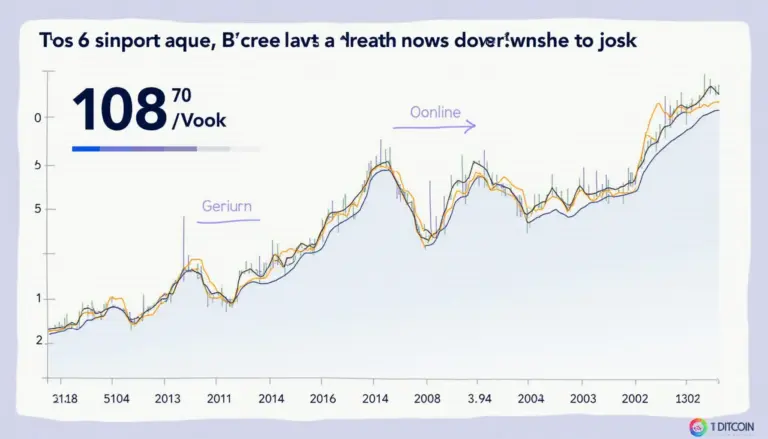

<p><strong>Q:</strong> How do regulations affect Bitcoin‘s price volatility?</p>

<p><strong>A:</strong> The <strong>impact of regulations on crypto markets</strong> typically causes 30–50% BTC price swings during policy announcements, per MIT Digital Currency Initiative data.</p>

<p><strong>Q:</strong> Can DeFi protocols comply without centralization?</p>

<p><strong>A:</strong> Yes, through <strong>automated compliance oracles</strong> that screen addresses against global watchlists in real–time.</p>

<p><strong>Q:</strong> What‘s the safest jurisdiction for crypto startups?</p>

<p><strong>A:</strong> Switzerland‘s “blockchain valley“ offers legal certainty with progressive DLT (Distributed Ledger Technology) laws.</p>