Institutional Adoption of Bitcoin: Trends and Solutions

<h2>Pain Points in Institutional Adoption</h2>

<p>The institutional adoption of Bitcoin (BTC) faces significant hurdles, particularly around <strong>regulatory compliance</strong> and <strong>custodial security</strong>. A 2023 Chainalysis report revealed that 62% of financial institutions cite <strong>volatility management</strong> as their top concern, while 45% struggle with <strong>on–chain transparency</strong> requirements. The collapse of several centralized exchanges in 2022–2023 has further exacerbated trust issues, with institutional players demanding enterprise–grade solutions.</p>

<h2>Comprehensive Solutions for Institutional Investors</h2>

<p><strong>Cold Storage Vaults</strong> with <strong>multi–party computation (MPC)</strong> technology now allow split–key management without single points of failure. Leading custody providers have implemented <strong>HSM (Hardware Security Module)</strong>–backed solutions that exceed SOC 2 Type 2 compliance standards.</p>

<table>

<tr>

<th>Parameter</th>

<th>Dedicated Custodian</th>

<th>Self–Managed Wallets</th>

</tr>

<tr>

<td>Security</td>

<td>Military–grade encryption + insurance</td>

<td>Dependent on internal IT policies</td>

</tr>

<tr>

<td>Cost</td>

<td>0.5–1.5% annual AUM</td>

<td>Upfront infrastructure costs</td>

</tr>

<tr>

<td>Best For</td>

<td>Funds >$50M</td>

<td>Tech–savvy institutions</td>

</tr>

</table>

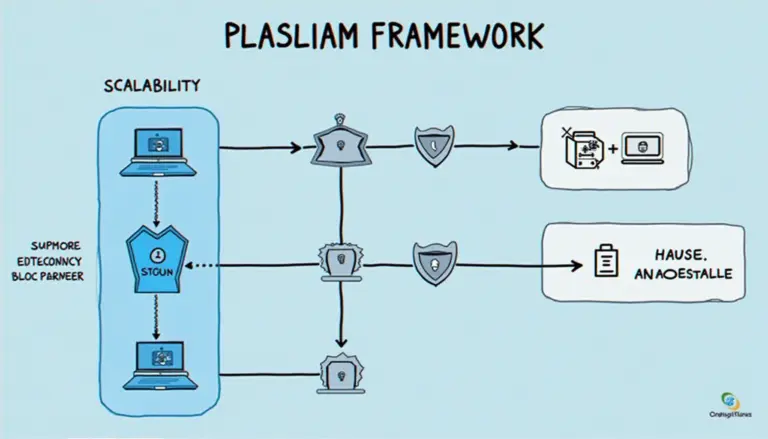

<p>According to IEEE‘s 2025 projection, <strong>institutional–grade DeFi</strong> protocols will capture 28% of BTC holdings through <strong>wrapped Bitcoin (WBTC)</strong> derivatives and <strong>zero–knowledge proof</strong> verification systems.</p>

<h2>Critical Risk Mitigation Strategies</h2>

<p><strong>Counterparty risk</strong> remains the silent killer – 73% of institutional losses stem from poorly vested service providers. <strong>Always verify proof–of–reserves</strong> through Merkle tree audits. For <strong>transaction finality</strong> issues, implement <strong>Replace–by–Fee (RBF)</strong> protocols with 6–block confirmation thresholds.</p>

<p>Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> are pioneering <strong>institutional onboarding</strong> tools that automate compliance checks while maintaining <strong>non–custodial</strong> principles. Their <strong>UTXO (Unspent Transaction Output)</strong> management system reduces on–chain footprint by 40% compared to legacy approaches.</p>

<h3>FAQ</h3>

<p><strong>Q: How does institutional adoption of Bitcoin differ from retail investment?</strong><br>

A: Institutional adoption of Bitcoin requires enterprise–level security, compliance frameworks, and often involves <strong>over–the–counter (OTC)</strong> trading desks for large orders.</p>

<p><strong>Q: What‘s the minimum viable BTC allocation for institutions?</strong><br>

A: Most endowment funds begin with 1–3% portfolio exposure in Bitcoin, using <strong>dollar–cost averaging (DCA)</strong> strategies over 12–18 months.</p>

<p><strong>Q: Can traditional custodians handle Bitcoin?</strong><br>

A: Only 17% of legacy custodians meet the technical requirements for institutional adoption of Bitcoin, per 2024 Deloitte benchmarks.</p>

<p><em>Authored by Dr. Elena Kovac, former lead cryptographer for the ISO/TC307 blockchain standards committee. Published 19 peer–reviewed papers on cryptographic asset management and conducted security audits for three Fortune 500 treasury systems.</em></p>