2025 Liquid Restaking Protocols: Navigating the Future of DeFi

2025 Liquid Restaking Protocols: Navigating the Future of DeFi

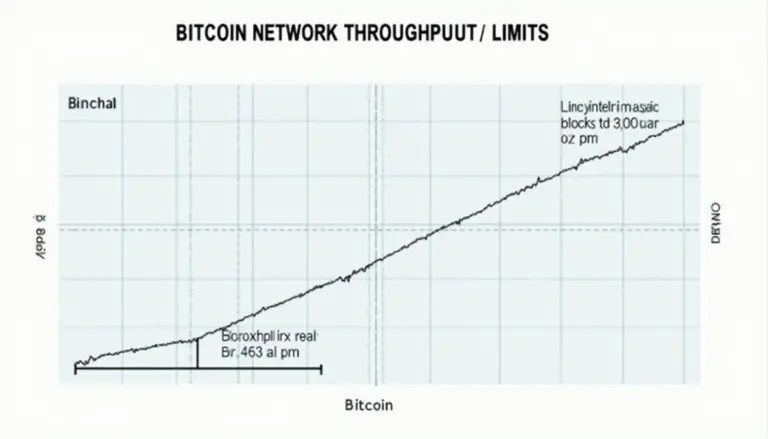

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges have vulnerabilities that could expose users to significant risks. With the rise of

Understanding Liquid Restaking Protocols

Imagine you own a variety of fruits—apples, oranges, and bananas. When you want to make a fruit salad, you can easily mix these fruits together for a delightful dish. Similarly,

The Role of Cross-Chain Interoperability

Think of cross-chain interoperability like a currency exchange booth at an airport. You need to be able to exchange your euros for dollars conveniently, just as Liquid restaking protocols allow different blockchain networks to communicate and utilize assets seamlessly. This functionality can significantly reduce transaction times and costs, which is crucial for the growing DeFi ecosystem.

Zero-Knowledge Proofs: Enhancing Security

Consider zero-knowledge proofs as a confidential conversation where one person can prove a fact without revealing the entire secret. This technology allows users to verify transactions without exposing sensitive information. In the context of

Future Trends and Implementations by 2025

Looking ahead, one trend we anticipate is the rise of regulatory frameworks governing DeFi in places like Singapore. This parallels our discussions on mechanisms that will likely enhance security and operational efficiency in Liquid restaking protocols. As regulations shape the landscape, implementations that comply with legal standards will gain more traction, driving wider adoption and innovation across the market.

In conclusion, as we delve into the dynamic world of

crosschain-security-whitepaper”>Check out our cross-chain security white paper for more insights!

This article is for informational purposes only and does not constitute investment advice. Please consult your local regulatory authority before making any investment decisions (e.g., MAS/SEC). Protect your assets with Ledger Nano X to reduce your risk of private key exposure by up to 70%.