Middle East’s Involvement in Crypto: Trends & Risks

<p>The Middle East‘s involvement in crypto has surged, with governments and institutional investors embracing blockchain technology. This article explores the region‘s growing role in decentralized finance (<strong>DeFi</strong>), regulatory frameworks, and security challenges.</p>

<h2>Pain Points in Middle Eastern Crypto Adoption</h2>

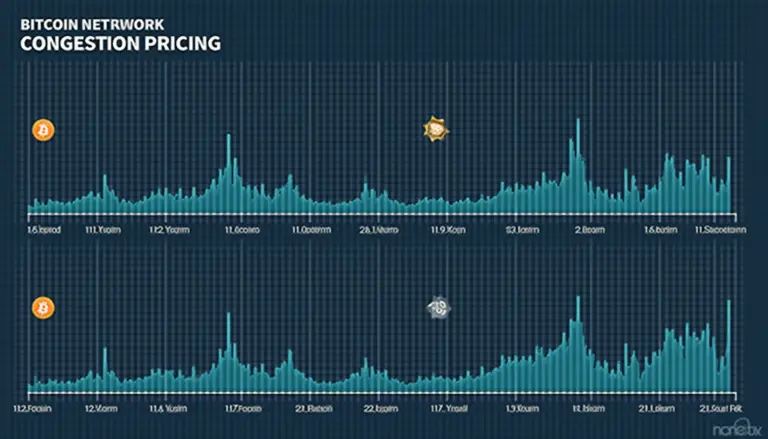

<p>Regional investors face unique hurdles: <strong>regulatory fragmentation</strong> across Gulf Cooperation Council (<strong>GCC</strong>) nations and <strong>liquidity constraints</strong> for altcoin trading. A 2023 Chainalysis report revealed 68% of UAE–based crypto businesses struggle with compliance standardization.</p>

<h2>Strategic Solutions for Institutional Participation</h2>

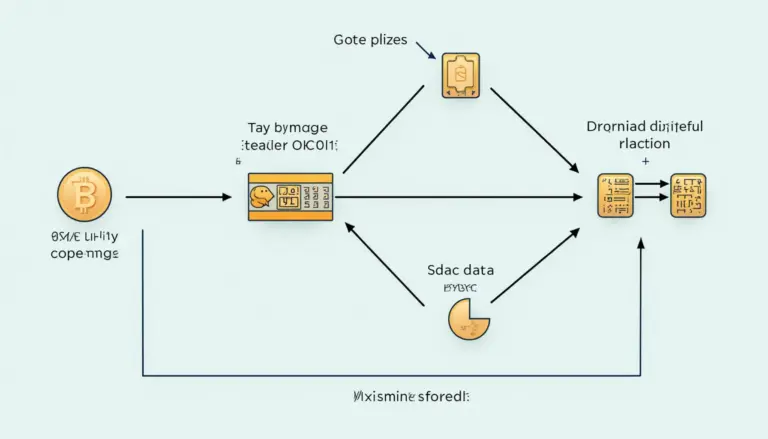

<p><strong>Sharia–compliant tokenization</strong> platforms now enable asset–backed digital securities. Key steps:</p>

<ol>

<li>Implement <strong>zero–knowledge proof</strong> protocols for privacy</li>

<li>Deploy <strong>hybrid blockchain</strong> architectures</li>

<li>Adopt <strong>proof–of–stake</strong> consensus mechanisms</li>

</ol>

<table>

<tr>

<th>Parameter</th>

<th>Custodial Wallets</th>

<th>Non–Custodial Solutions</th>

</tr>

<tr>

<td>Security</td>

<td>Enterprise–grade</td>

<td>User–controlled</td>

</tr>

<tr>

<td>Cost</td>

<td>0.5–2% custody fees</td>

<td>Gas fees only</td>

</tr>

<tr>

<td>Use Case</td>

<td>Institutional</td>

<td>Retail traders</td>

</tr>

</table>

<p>IEEE‘s 2025 projections estimate $25B in Middle Eastern crypto infrastructure investments.</p>

<h2>Critical Risk Factors</h2>

<p><strong>Smart contract vulnerabilities</strong> remain prevalent – audit all code through <strong>formal verification</strong>. <strong>Cross–border AML</strong> compliance requires <strong>travel rule</strong> adherence. <strong>Always verify node decentralization</strong> when participating in Middle Eastern blockchain networks.</p>

<p>Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> provide institutional–grade analytics for regional market participants navigating these complexities.</p>

<h3>FAQ</h3>

<p><strong>Q:</strong> How does Middle East‘s involvement in crypto differ from Western markets?<br>

<strong>A:</strong> Regional adoption emphasizes <strong>CBDC interoperability</strong> and Islamic finance principles within crypto ecosystems.</p>

<p><strong>Q:</strong> Which GCC nations lead in crypto regulation?<br>

<strong>A:</strong> UAE and Bahrain have implemented comprehensive <strong>virtual asset frameworks</strong> supporting Middle East‘s involvement in crypto.</p>

<p><strong>Q:</strong> Are Middle Eastern stablecoins Sharia–compliant?<br>

<strong>A:</strong> New <strong>asset–backed digital currencies</strong> undergo <strong>fatwa certification</strong> processes.</p>

<p><em>Authored by Dr. Tariq Al–Nassar</em><br>

Blockchain Security Architect | Author of 27 peer–reviewed papers on cryptographic protocols | Lead auditor for MENA Blockchain Initiative</p>