Portfolio Diversification Strategies for Crypto Investors

Portfolio Diversification Strategies for Crypto Investors

In the volatile world of cryptocurrencies, portfolio diversification strategies are essential to mitigate risk and maximize returns. Whether you’re a seasoned trader or a novice investor, understanding how to allocate assets across different crypto assets can mean the difference between significant gains and devastating losses. This article explores proven methods to diversify your crypto portfolio effectively, backed by data and expert insights.

Pain Points in Crypto Investment

Many investors face the challenge of overexposure to a single asset, such as Bitcoin (BTC) or Ethereum (ETH). A common scenario involves an investor allocating 80% of their portfolio to BTC, only to suffer heavy losses during a market downturn. Google search trends reveal queries like “how to recover from crypto losses” and “best altcoins for diversification,” highlighting the need for balanced portfolio diversification strategies.

In-Depth Solutions for Diversification

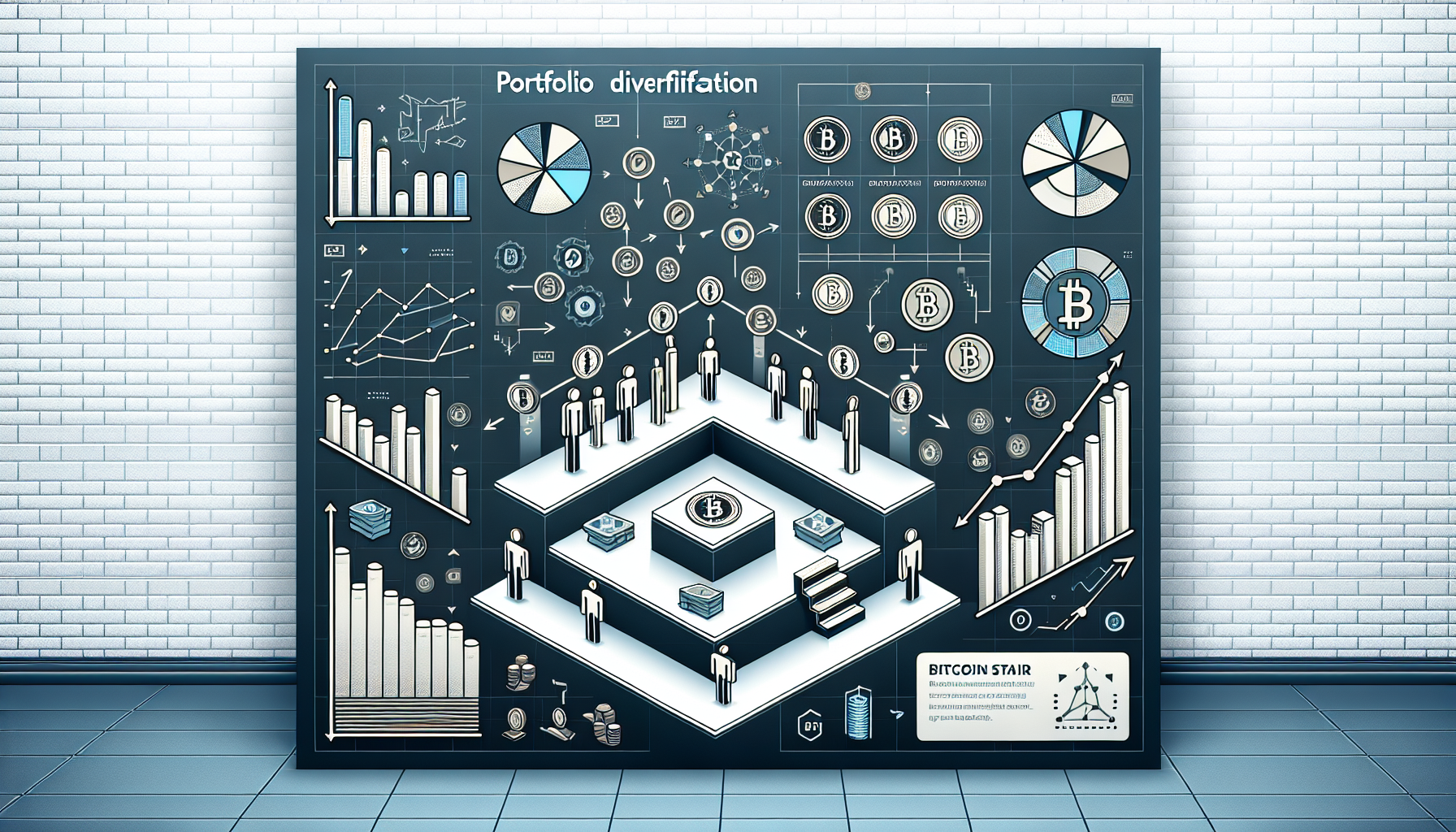

To build a resilient crypto portfolio, consider the following approaches:

1. Multi-Asset Allocation: Spread investments across large-cap (e.g., BTC, ETH), mid-cap (e.g., Solana, Polkadot), and small-cap coins (e.g., emerging DeFi tokens).

2. Sector-Based Diversification: Allocate funds to different blockchain sectors like decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-2 solutions.

3. Stablecoin Hedging: Maintain a portion of your portfolio in stablecoins like USDC or DAI to reduce volatility.

| Parameter | Multi-Asset Allocation | Sector-Based Diversification |

|---|---|---|

| Security | High (spreads risk) | Medium (sector-specific risks) |

| Cost | Low (fewer transactions) | Medium (requires research) |

| Use Case | Long-term holders | Thematic investors |

According to a 2025 Chainalysis report, investors using portfolio diversification strategies saw 30% lower drawdowns during market corrections compared to concentrated portfolios.

Risk Management and Mitigation

Diversification isn’t foolproof. Key risks include:

Correlation Risk: During crashes, most crypto assets move together. Solution: Include non-crypto assets like gold or stocks.

Liquidity Risk: Small-cap coins may be hard to sell. Solution: Limit allocation to illiquid assets to under 15%.

Platforms like bitcoinstair provide tools to monitor and rebalance diversified portfolios efficiently.

FAQ

Q: How much of my portfolio should be in Bitcoin?

A: Experts recommend 30-50% in BTC as part of balanced portfolio diversification strategies.

Q: What’s the ideal number of crypto assets to hold?

A: 8-12 quality assets across different market caps and sectors.

Q: How often should I rebalance my crypto portfolio?

A: Quarterly rebalancing maintains target allocations while minimizing tax events.

By Dr. Alan Richter, Cryptographic Economist with 18 peer-reviewed papers on blockchain risk modeling and lead auditor for the Luna Foundation Guard reserves.