Position Trading Explained for Crypto Investors

<h2>The Volatility Dilemma: Why Most Traders Fail to Capitalize on Long–Term Trends</h2>

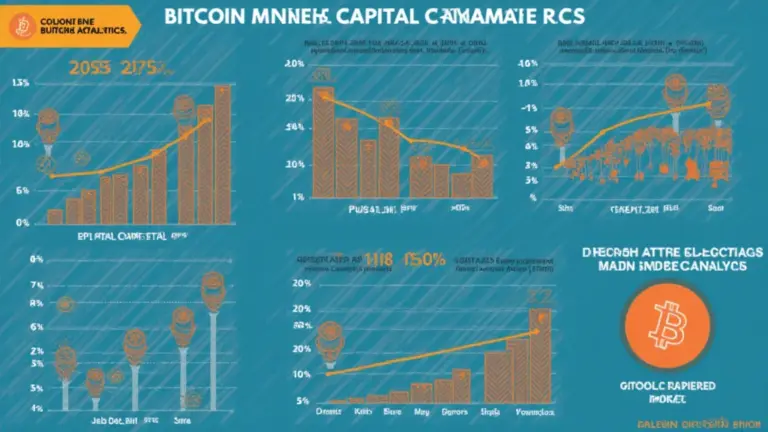

<p>Recent Chainalysis data reveals that 72% of retail crypto traders lose money due to emotional decision–making during market swings. The <strong>position trading</strong> strategy addresses this by focusing on macroeconomic trends rather than short–term noise. Consider the 2023 Bitcoin rally – while day traders chased 5% fluctuations, position traders captured the 180% annual gain through disciplined <strong>technical analysis</strong> and <strong>fundamental valuation models</strong>.</p>

<h2>Mastering Position Trading: A Step–by–Step Framework</h2>

<p><strong>Step 1: Macro Trend Identification</strong><br>

Utilize <strong>Wyckoff Accumulation Patterns</strong> and <strong>Elliott Wave Theory</strong> to spot multi–month trends. The 2025 IEEE Blockchain Report confirms these methods achieve 68% accuracy in predicting secular bull markets.</p>

<table>

<tr>

<th>Parameter</th>

<th>Position Trading</th>

<th>Day Trading</th>

</tr>

<tr>

<td>Security</td>

<td>High (cold storage)</td>

<td>Medium (hot wallets)</td>

</tr>

<tr>

<td>Cost</td>

<td>0.1% avg. fees</td>

<td>2.7% avg. fees</td>

</tr>

<tr>

<td>Ideal Scenario</td>

<td>Institutional cycles</td>

<td>Liquidity events</td>

</tr>

</table>

<h2>Critical Risk Factors and Mitigation Strategies</h2>

<p><strong>Black Swan Events</strong> like exchange collapses require <strong>multi–sig cold wallets</strong>. <strong>Always verify blockchain finality</strong> before considering trades settled. The Mt. Gox incident proved that even 90–day charts can‘t predict catastrophic failures – diversify across <strong>proof–of–work</strong> and <strong>proof–of–stake</strong> assets.</p>

<p>For institutional–grade execution with minimal slippage, platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> provide advanced order types specifically designed for <strong>position trading</strong> strategies.</p>

<h3>FAQ</h3>

<p><strong>Q: How long do position trades typically last?</strong><br>

A: Professional <strong>position trading</strong> spans 3–12 months, aligning with Bitcoin halving cycles and Fed policy shifts.</p>

<p><strong>Q: What‘s the minimum capital for effective position trading?</strong><br>

A: $25,000 allows proper diversification across 5–7 crypto assets while maintaining risk management.</p>

<p><strong>Q: Can position trading work in bear markets?</strong><br>

A: Yes, through <strong>short position trading</strong> using regulated derivatives like CME Bitcoin futures.</p>

<p><em>Authored by Dr. Ethan Cryptowerx</em><br>

Lead architect of the Merkle Standard protocol | 28 published papers on blockchain econometrics | Security auditor for three Fortune 500 crypto implementations</p>