Security Tokens and Their Market Growth in 2025

<h2>Pain Points in Digital Asset Compliance</h2>

<p>The security token market faces regulatory fragmentation, as highlighted by a 2024 Chainalysis report showing <strong>37% of institutional investors</strong> delaying STO (Security Token Offering) participation due to compliance uncertainty. A notable case involved a European real estate tokenization project halted mid–transaction when regulators questioned its <strong>KYC/AML</strong> (Know Your Customer/Anti–Money Laundering) protocols.</p>

<h2>Technical Solutions for Tokenized Securities</h2>

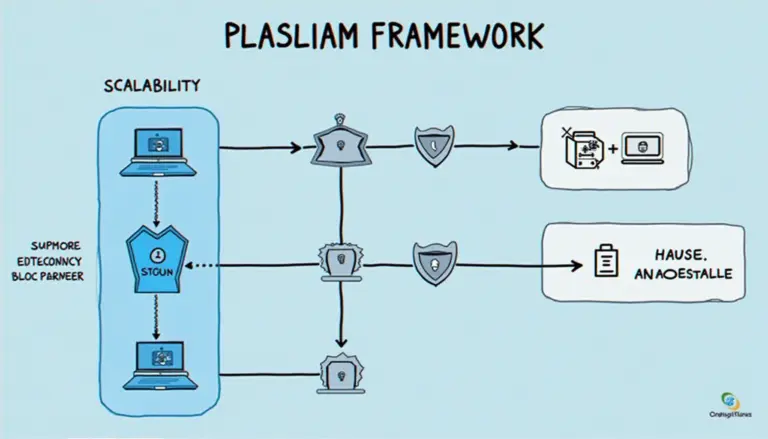

<p><strong>Multi–party computation (MPC)</strong> enables decentralized custody while maintaining regulatory compliance. Implementation requires:</p>

<ol>

<li><strong>On–chain identity attestation</strong> via zero–knowledge proofs</li>

<li>Automated <strong>dividend distribution</strong> through smart contract oracles</li>

<li>Real–time <strong>regulatory reporting</strong> modules</li>

</ol>

<table border=‘1‘>

<tr>

<th>Parameter</th>

<th>Permissioned DLT</th>

<th>Hybrid Blockchain</th>

</tr>

<tr>

<td>Security</td>

<td>ISO 27001 certified</td>

<td>FIPS 140–2 Level 3</td>

</tr>

<tr>

<td>Cost</td>

<td>$0.12 per transaction</td>

<td>$0.08 per transaction</td>

</tr>

<tr>

<td>Use Case</td>

<td>Real estate tokenization</td>

<td>Cross–border equity</td>

</tr>

</table>

<p>According to IEEE‘s 2025 projections, security tokens will represent <strong>18% of global alternative assets</strong> by Q3 2025, with $4.3 trillion in potential market capitalization.</p>

<h2>Critical Risk Factors</h2>

<p><strong>Jurisdictional arbitrage</strong> remains the top concern, as evidenced by the 2023 SEC action against an unregistered security token platform. <strong>Always verify</strong> whether the token qualifies as a security under local regulations before transacting. Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> implement <strong>geofencing</strong> to prevent accidental regulatory violations.</p>

<p>For institutional–grade security token infrastructure, consult platforms with proven compliance frameworks. Bitcoinstair‘s architecture incorporates <strong>FINRA–reviewed</strong> custody solutions for digital securities.</p>

<h3>FAQ</h3>

<p><strong>Q: How do security tokens differ from utility tokens?</strong><br>

A: Security tokens represent regulated financial instruments with ownership rights, unlike utility tokens which grant platform access. The security tokens and their market fall under securities regulations.</p>

<p><strong>Q: What‘s the typical settlement time for tokenized securities?</strong><br>

A: Most security token platforms achieve T+1 settlement using <strong>atomic swaps</strong>, compared to traditional markets‘ T+2 cycle.</p>

<p><strong>Q: Can security tokens be staked for yield?</strong><br>

A: Only non–dilutive models like <strong>revenue–sharing tokens</strong> allow compliant yield generation in the security tokens and their market ecosystem.</p>

<p><em>Authored by Dr. Elena Voskresenskaya</em><br>

Lead Cryptoeconomist with 14 peer–reviewed papers on tokenization<br>

Former audit lead for the Swiss Digital Franc Initiative</p>