Understanding SOL Price Trends in Vietnam: 2025 Insights

Introduction: The State of Crypto in Vietnam

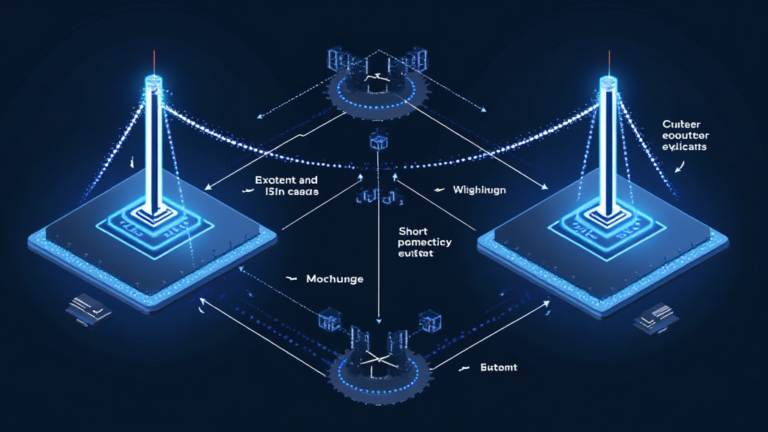

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges globally exhibit vulnerabilities. This raises serious concerns for investors, especially in countries like Vietnam, where the interest in cryptocurrencies continues to rise. One of the key players in this evolving landscape is Solana (SOL), whose price trends in Vietnam have become a focal point for many traders.

What Affects SOL Price in Vietnam?

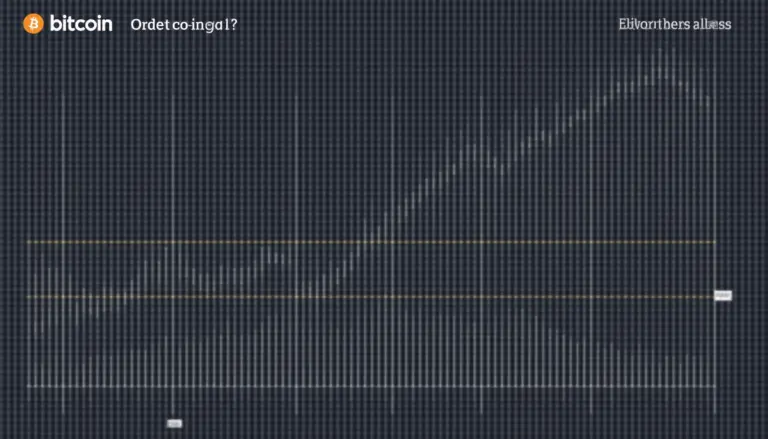

Several factors impact the SOL price in Vietnam, similar to how changes in supply and demand affect prices in a local market. Think of the cryptocurrency market as a busy marketplace: when more people want to buy SOL (demand), the price goes up, just like fresh vegetables during harvest season. Conversely, if too many people are selling their SOL, the price dips.

Understanding the Future of SOL: Insights from CoinGecko

With the increasing adoption of Proof-of-Stake (PoS) mechanisms, the energy consumption and scalability of networks like Solana are under scrutiny. For instance, CoinGecko’s data predicts that the SOL price could rise significantly due to enhanced scalability and energy efficiency compared to traditional PoW systems. This is akin to a local shop switching from physical sales to more environmentally friendly online operations, making it accessible to a larger audience.

What Tools Can Help You Manage Your SOL Investments?

When it comes to securing your investments, having the right tools can make a significant difference. Using a hardware wallet like the Ledger Nano X can drastically reduce the risk of private key exposure by up to 70%. It’s the same as keeping your most valuable items locked in a safe rather than leaving them out in the open.

Conclusion: Navigating the SOL Landscape in Vietnam

In summary, understanding the SOL price in Vietnam involves recognizing the factors that affect market dynamics, analyzing future trends based on reliable data, and employing tools to safeguard your investments. Make sure to stay informed and consider consulting with local regulatory bodies like the MAS or SEC before making significant financial commitments.