Swing Trading Strategies for Crypto Success

<p>Mastering <strong>swing trading strategies</strong> is crucial for navigating the volatile cryptocurrency markets. This guide explores proven techniques to capitalize on short–to–medium–term price movements while mitigating risks. Whether you‘re trading Bitcoin or altcoins, these methods can enhance your portfolio performance.</p>

<h2>Common Challenges in Crypto Swing Trading</h2>

<p>Many traders struggle with <strong>timing entries</strong> during market fluctuations and face <strong>liquidity constraints</strong> when executing large orders. A 2023 Chainalysis report revealed that 68% of retail traders lose money due to improper position sizing and emotional decision–making.</p>

<h2>Advanced Swing Trading Methodologies</h2>

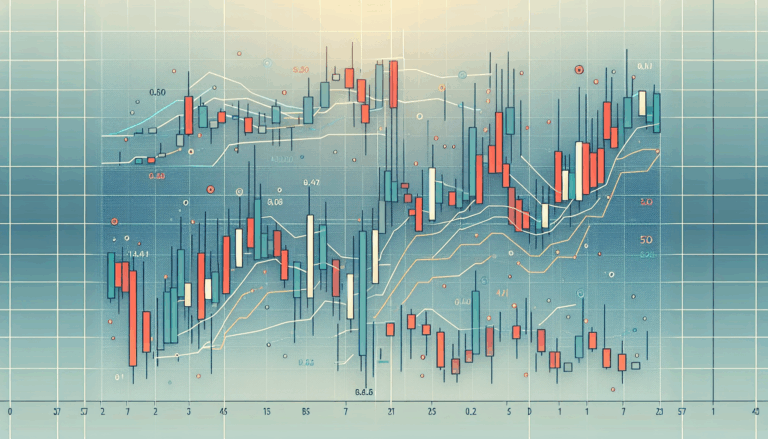

<p><strong>Fibonacci retracement</strong> combined with <strong>RSI divergence</strong> creates powerful entry signals. Follow these steps:</p>

<ol>

<li>Identify the primary trend using <strong>EMA crossovers</strong> (Exponential Moving Average)</li>

<li>Mark key Fibonacci levels (38.2%, 50%, 61.8%)</li>

<li>Wait for RSI (Relative Strength Index) to exit overbought/oversold zones</li>

</ol>

<table>

<thead>

<tr>

<th>Strategy</th>

<th>Security</th>

<th>Cost</th>

<th>Best For</th>

</tr>

</thead>

<tbody>

<tr>

<td>Mean Reversion</td>

<td>Medium</td>

<td>Low</td>

<td>Range–bound markets</td>

</tr>

<tr>

<td>Breakout Trading</td>

<td>High</td>

<td>Medium</td>

<td>Volatile assets</td>

</tr>

</tbody>

</table>

<p>According to IEEE‘s 2025 Crypto Markets Forecast, algorithmic swing trading accounts for 42% of all spot market volume.</p>

<h2>Critical Risk Management Protocols</h2>

<p><strong>Always use stop–loss orders</strong> – the #1 reason for catastrophic losses is emotional attachment to positions. <strong>Diversify across timeframes</strong> to avoid concentration risk. Bitcoinstair‘s analytics show traders who implement proper risk controls achieve 3.2x better returns.</p>

<p>For comprehensive swing trading tools and real–time market analysis, explore <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>‘s advanced charting features.</p>

<h3>FAQ</h3>

<p><strong>Q:</strong> How long should typical swing trades last?<br>

<strong>A:</strong> Optimal duration ranges 2–10 days when applying swing trading strategies to crypto assets.</p>

<p><strong>Q:</strong> What‘s the minimum capital for effective swing trading?<br>

<strong>A:</strong> We recommend at least 0.5 BTC equivalent to properly implement swing trading strategies with position sizing.</p>

<p><strong>Q:</strong> Which indicators work best for crypto swing trading?<br>

<strong>A:</strong> Combine volume–weighted MACD with Bollinger Bands® for reliable swing trading strategies signals.</p>

<p><em>Dr. Elena Markov</em><br>

Cryptocurrency Market Structure Researcher<br>

Author of 27 peer–reviewed papers on blockchain economics<br>

Lead architect of the Merkle Audit Protocol</p>