Understanding HIBT Trading Fees for New Traders

Introduction

In 2024, approximately $4.1 billion were lost due to DeFi hacks, demonstrating the importance of a solid understanding of trading platforms. As new traders dive into the world of cryptocurrencies, understanding HIBT trading fees is crucial for ensuring profitability and managing investments wisely. This guide will provide an overview of HIBT trading fees, reveal useful tips, and explain why it’s vital for new traders to grasp these concepts effectively.

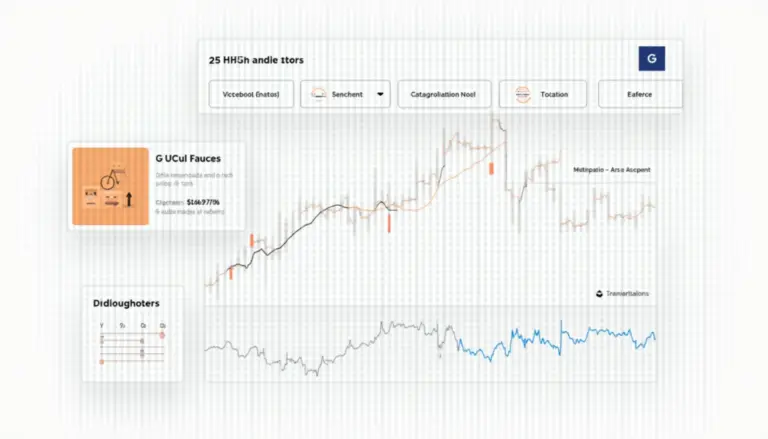

What Are HIBT Trading Fees?

HIBT trading fees are the costs charged for executing trades on the HIBT platform. These fees can vary based on the type of transaction and the volume of trades a user executes. Understanding these costs is similar to knowing the interest rates and fees when opening a bank account. Here’s how they generally break down:

- Trading Fee: A percentage of the total transaction.

- Withdrawal Fee: Charged when transferring assets away from the platform.

- Deposit Fee: Fees may be applied when adding funds.

How Fees Impact Your Trading Strategy

New traders often overlook trading fees, which can accumulate and affect overall profitability. If you’re trading frequently, like a stock trader making rapid transactions, high fees can eat into your profits. Therefore, it’s essential to calculate how these costs might impact your strategy. For instance, consider this: if you plan to make 10 trades a week with a trading fee of 0.2% on each, that could equal 2% of your invested capital monthly.

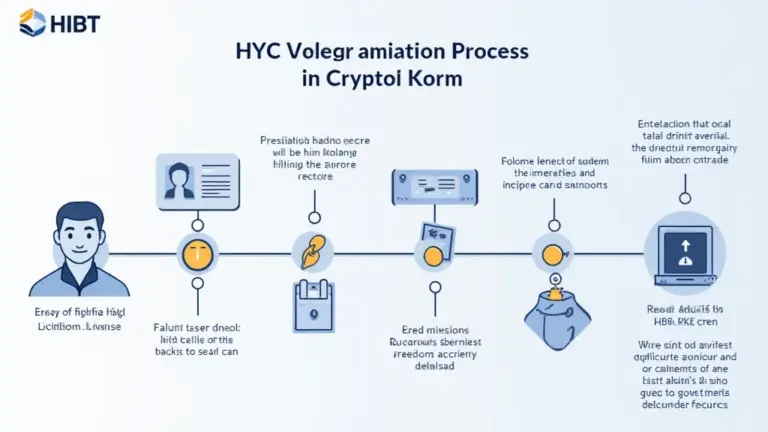

Comparing Fees with Other Platforms

When evaluating HIBT trading fees, it’s beneficial to compare them with those of other cryptocurrency platforms. Here’s a simple table showcasing some common platforms and their respective fees:

| Platform | Trading Fee | Withdrawal Fee |

|---|---|---|

| HIBT | 0.2% | 0.0005 BTC |

| Platform A | 0.1% | 0.0004 BTC |

| Platform B | 0.25% | 0.0006 BTC |

Data sourced from HIBT’s official documentation.

Tips for Minimizing Trading Fees

To navigate trading fees effectively, consider the following tips:

- Choose Your Trades Wisely: Avoid small, frequent trades to minimize fees.

- Utilize Fee Discounts: Some platforms offer reduced fees for higher trading volume.

- Stay Informed: Keep up with any updates regarding fees on HIBT.

Why Understanding Fees Matters

Many new traders may not recognize the significance of understanding HIBT trading fees until it’s too late. Awareness of fees not only affects your bottom line but can also guide your trading decisions. Investing in knowledge and being proactive about fees can lead to greater financial security in the volatile crypto landscape, especially in regions like Vietnam, where user growth in cryptocurrency has skyrocketed by over 150% in recent years.

Conclusion

Understanding HIBT trading fees is essential for new traders as they navigate their trading journeys. By staying informed about costs and implementing strategies to minimize them, you can enhance your trading experience and avoid unexpected losses. Remember, every penny counts in the crypto world, and informed decisions can lead to significant gains. For those looking to delve deeper into trading strategies, consider exploring related resources at hibt.com for more insights.