Understanding Market Cycles: A Comprehensive Guide

<p>Market cycles represent a crucial aspect of trading and investing, particularly in the cryptocurrency sector. As enthusiasts dive into this innovative space, they often grapple with market volatility, price trends, and the understanding of market cycles. To effectively navigate trading strategies, grasping these cycles becomes a fundamental skill that every investor must master.</p>

<h2>Pain Point Scenario</h2>

<p>Imagine a cryptocurrency investor who bought Bitcoin at its peak price. As the market began to decline, they experienced significant losses, feeling lost without an understanding of market cycles. High–profile cases like these spotlight the importance of recognizing market behavior patterns. Many users falter due to ignorance of these cycles, resulting in emotional trading decisions driven by fear or greed.</p>

<h2>Solutions Deep Dive</h2>

<p>To address these challenges, investors should adopt a structured approach to <strong>understanding market cycles</strong>. Here’s a step–by–step method to broaden your comprehension:</p>

<ol>

<li>Study Historical Data: Analyze past market trends and cycles to identify recurring patterns.</li>

<li>Utilize Technical Indicators: Tools such as Moving Averages (MA) and Relative Strength Index (RSI) can provide insights into market conditions.</li>

<li>Implement Risk Management: Establishing stop–loss orders and position sizes can help mitigate potential losses.</li>

</ol>

<h3>Comparison Table</h3>

<table>

<tr>

<th>Parameter</th>

<th>Solution A: Advanced Trading Strategies</th>

<th>Solution B: Basic Buy and Hold</th>

</tr>

<tr>

<td>Safety</td>

<td>High (due to analysis and strategy)</td>

<td>Moderate (depends on market trends)</td>

</tr>

<tr>

<td>Cost</td>

<td>Higher (requires investment in tools)</td>

<td>Low (minimal intervention)</td>

</tr>

<tr>

<td>Applicable Scenario</td>

<td>Volatile markets</td>

<td>Stable markets</td>

</tr>

</table>

<p>According to a report by <strong>Chainalysis</strong>, the trends predicted for 2025 indicate an increased reliance on analytical tools to make informed trading decisions. Understanding how to navigate market cycles is essential for capitalizing on this volatility.</p>

<h2>Risk Warnings</h2>

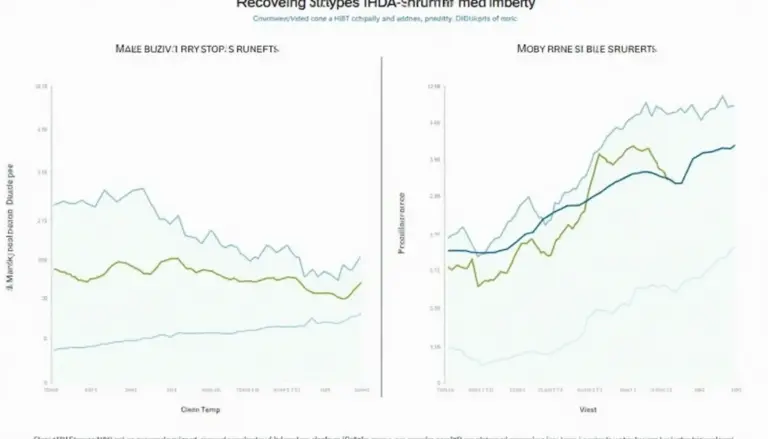

<p>Despite the advantages of comprehending market cycles, there are inherent risks that traders must acknowledge. While trading can be rewarding, it’s crucial to approach with caution. Keep in mind the following:</p>

<ul>

<li><strong>Never invest more than you can afford to lose.</strong></li>

<li><strong>Diversification is key.</strong> Spread investments across various assets to mitigate risks.</li>

<li><strong>Stay informed on global market trends.</strong> External factors can impact crypto markets significantly.</li>

</ul>

<p>By integrating such strategies, investors can better manage risks associated with market fluctuations.</p>

<p>At <strong><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></strong>, we prioritize your trading education and success. Equip yourself with knowledge and strategies to excel in the dynamic cryptocurrency landscape.</p>

<p>In conclusion, <strong>understanding market cycles</strong> is paramount for every investor looking to navigate the complex world of cryptocurrencies successfully. Embracing analytical tools and maintaining an informed approach can set you on a path toward achieving your investment goals.</p>

<h2>FAQ</h2>

<p>Q: What are market cycles in cryptocurrency?<br>A: Market cycles refer to the repetitive patterns of bull and bear markets, which are vital for understanding market cycles.</p>

<p>Q: How can I avoid emotional trading?<br>A: By understanding market cycles, you can create a strategy that mitigates emotional trading.</p>

<p>Q: What tools can help in understanding market cycles?<br>A: Technical indicators like MA and RSI are useful in understanding market cycles.</p>