Vietnam Blockchain Fintech Trends: 2025 Outlook

Vietnam Blockchain Fintech Trends: 2025 Outlook

According to Chainalysis 2025 data, over 73% of cross-chain bridges worldwide have vulnerabilities. As the Vietnamese fintech market continues to evolve, understanding these risks becomes imperative. In this report, we dive into the latest Vietnam blockchain fintech trends, specific implementations like cross-chain interoperability, and the promising applications of zero-knowledge proofs.

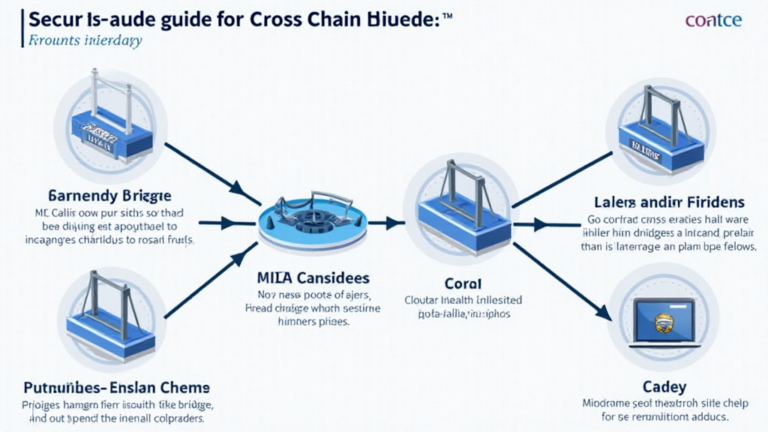

Understanding Cross-Chain Interoperability

Think of cross-chain interoperability like a currency exchange booth at the market. Just as you would swap VND for USD to make a purchase in another country, blockchain networks need a way to communicate and transfer value between themselves. This is crucial for developing a more connected crypto ecosystem. However, with 73% of these bridges being vulnerable, it’s essential to prioritize security.

The Rise of Zero-Knowledge Proofs

Zero-knowledge proofs function like a secret code that allows one party to prove to another that they know something, without revealing the actual information. For example, if you needed to validate your age to enter a bar without showing your ID, a zero-knowledge proof would let you confirm you’re over 21 without disclosing your exact birthdate. In the realm of Vietnam’s fintech, such mechanisms can enhance privacy whilst ensuring compliance with local regulations.

DeFi Regulation Trends in Singapore by 2025

As we look at the regulatory landscape in Southeast Asia, it’s noteworthy that Singapore is paving the way for DeFi regulations. By 2025, the Monetary Authority of Singapore (MAS) plans to introduce clearer guidelines aimed at ensuring user protection while encouraging innovation in finance. What can Vietnam learn from this trend? Establishing a supportive regulatory framework will be crucial for fostering growth in its blockchain sector.

Addressing Energy Consumption with PoS Mechanisms

Picture a bustling marketplace versus a quiet library. That’s the difference in energy consumption between proof-of-stake (PoS) mechanisms and traditional proof-of-work systems. PoS uses validators to confirm transactions, which significantly lowers energy usage, making it more sustainable for Vietnam’s fintech ecosystem. As more Vietnamese startups adopt PoS solutions, the impact on local energy resources will be noteworthy.

In summary, navigating the Vietnam blockchain fintech trends requires keeping an eye on security vulnerabilities, privacy enhancements, and regulatory developments. Tools like Ledger Nano X can mitigate risks, such as reducing private key exposure by up to 70%. Download our actionable toolkit to dive deeper into these trends.

Risk Disclaimer: This article does not constitute investment advice. We encourage readers to consult with local regulatory agencies (such as MAS or SEC) before making financial decisions.