Vietnam Crypto Portfolio Trackers: Navigating the Future of Digital Assets

Vietnam Crypto Portfolio Trackers: Navigating the Future of Digital Assets

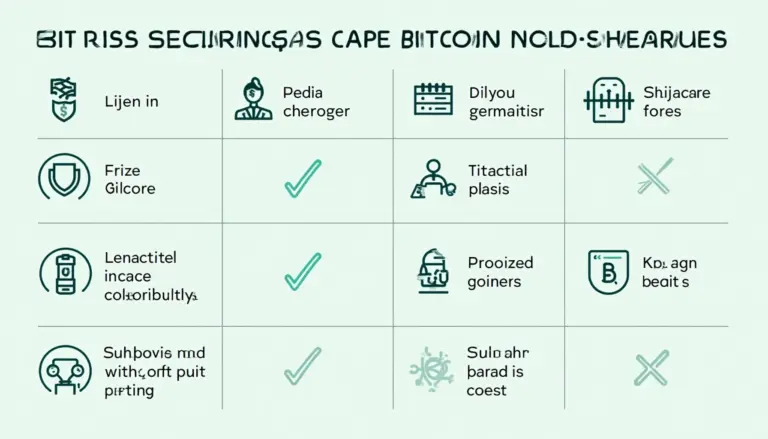

According to Chainalysis 2025 data, a staggering 73% of crypto portfolio trackers face security vulnerabilities, making it essential for investors to stay informed. In Vietnam, the rise of crypto assets has highlighted the need for robust portfolio management tools that can handle the complex nature of digital currencies.

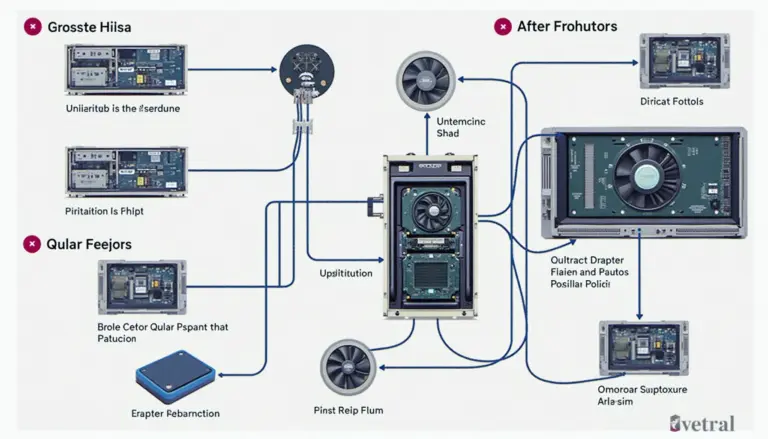

Understanding Crypto Portfolio Trackers

So, what’s a crypto portfolio tracker? Think of it like a personal finance app but for your digital assets. Just as you might use an app to track your spending, these trackers help you manage and monitor your crypto investments. They provide insights into portfolio performance and help assess risks. Users in Vietnam are increasingly turning to these tools to navigate the often turbulent waters of cryptocurrency.

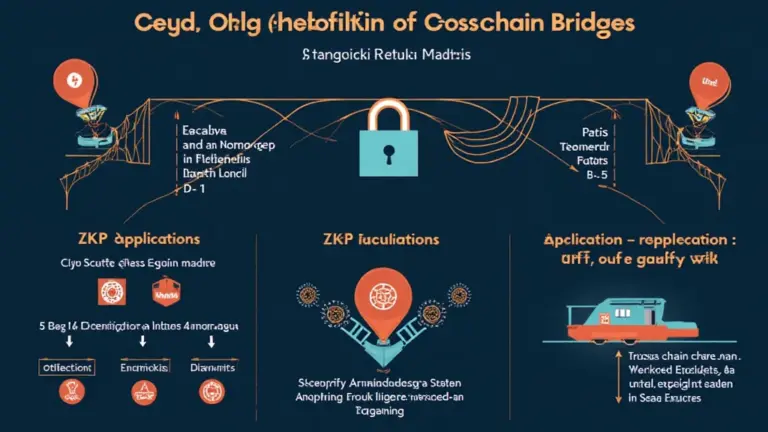

Why Cross-Chain Interoperability Matters

Cross-chain interoperability might sound technical, but let’s break it down. Imagine you’re at a market where different vendors accept different currencies. Cross-chain interoperability is like having a currency converter right there that lets you trade and spend without hassle. In Vietnam, as the DeFi ecosystem grows, these capabilities allow traders to move assets seamlessly between different blockchain platforms, enhancing liquidity and investment opportunities.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs (ZK proofs) are a fancy term that can seem daunting. But think of it like this: imagine needing to verify you have enough money to buy a coffee without showing your entire bank statement. ZK proofs allow transactions to be confirmed without revealing all the underlying details, ensuring privacy. As they gain traction, Vietnamese crypto investors are seeing the importance of privacy in an increasingly transparent digital world.

Preparing for Regulatory Changes in Vietnam

As we move closer to 2025, the Vietnamese government is expected to outline new cryptocurrency regulations. Just like a traffic light controls the flow of cars, regulations will guide how crypto transactions occur in the country. Investors should stay alert to these developments to ensure compliance and make informed decisions. Failing to adapt could risk investments significantly.

In summary, the rise of Vietnam crypto portfolio trackers is a crucial development for both novice and experienced investors. Understanding the tools available, the importance of cross-chain interoperability, the role of ZK proofs, and keeping an eye on regulatory changes is essential for optimizing digital asset management.

To get started on your crypto journey, download our comprehensive toolkit on crypto portfolio tracking today!