Understanding Vietnam DeFi Lending Platforms: A 2025 Insight

Understanding Vietnam DeFi Lending Platforms: A 2025 Insight

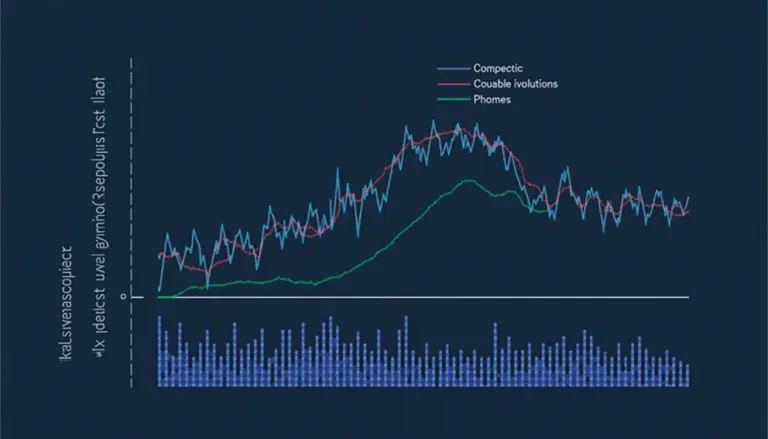

According to Chainalysis 2025 data, a staggering 73% of DeFi lending platforms globally are exposed to vulnerabilities. This statistic raises fundamental questions about the security and reliability of emerging financial systems, especially in regions like Vietnam where digital finance is rapidly evolving.

1. What Are Vietnam DeFi Lending Platforms?

Vietnam DeFi lending platforms act like your neighborhood moneylender but with a digital twist. Instead of high-interest rates and complicated repayment terms, these platforms offer decentralized loans through blockchain technology. This means that interactions are direct and often more transparent. Think of it as borrowing from a friend, but secured by smart contracts that ensure repayment without needing to trust each other personally.

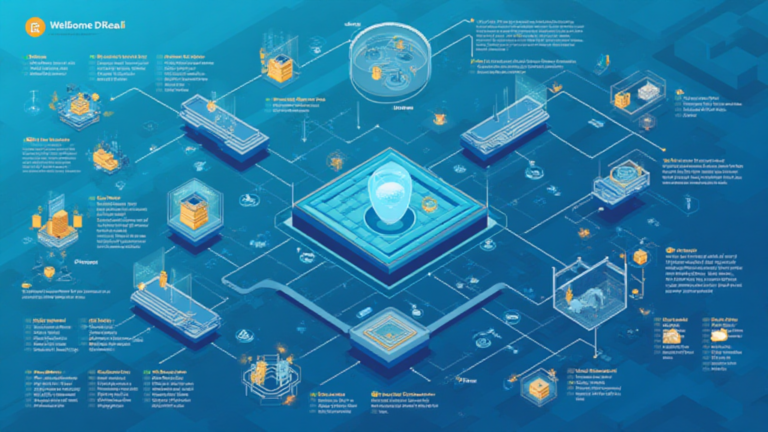

2. How Does Cross-Chain Interoperability Work?

Cross-chain interoperability is crucial for these platforms. Imagine it as a currency exchange booth — you can swap Vietnam Dong for Bitcoin with ease. DeFi platforms in Vietnam are beginning to implement solutions that allow for this type of currency exchange across different blockchains, enhancing liquidity and user experience. As this technology advances, it will greatly impact how efficiently users can access various lending options.

3. The Role of Zero-Knowledge Proof Applications

Zero-knowledge proofs can be likened to having a shopkeeper who can verify your age without showing your ID. In Vietnam DeFi lending, this technology allows lenders to approve loans without exposing the borrower’s identity or personal data. This fosters a more secure lending environment, mitigating risks of data breaches, and promoting privacy — a growing concern in today’s digital economy.

4. What to Expect in 2025?

As we look toward 2025, the landscape of Vietnam DeFi lending platforms is expected to evolve significantly. With regulatory frameworks tightening, understanding these changes will be vital for users and investors. Expect increased transparency and security measures to become a norm, as these platforms adapt to ensure compliance and customer trust. It’s like waiting for the bus; you need to know the schedule to avoid missing out!

In conclusion, the Vietnam DeFi lending platforms are on the brink of major innovations, with cross-chain interoperability and zero-knowledge proofs leading the charge. For those interested in exploring this exciting landscape further, be sure to download our DeFi toolkit to stay informed and prepared.

Disclaimer: This article does not constitute financial advice. Always consult with local regulatory authorities (like MAS/SEC) before making investment decisions.

To enhance your digital security, consider using a Ledger Nano X, which can reduce the risk of private key exposure by 70%.

Stay updated on the latest financial news with bitcoinstair.