Vietnam DeFi Liquidity Management: Challenges and Opportunities Ahead

Vietnam DeFi Liquidity Management: Challenges and Opportunities Ahead

According to Chainalysis 2025 data, over 73% of DeFi platforms struggle with liquidity management. In Vietnam, the need for efficient liquidity solutions is becoming increasingly critical, especially with the rise of DeFi projects.

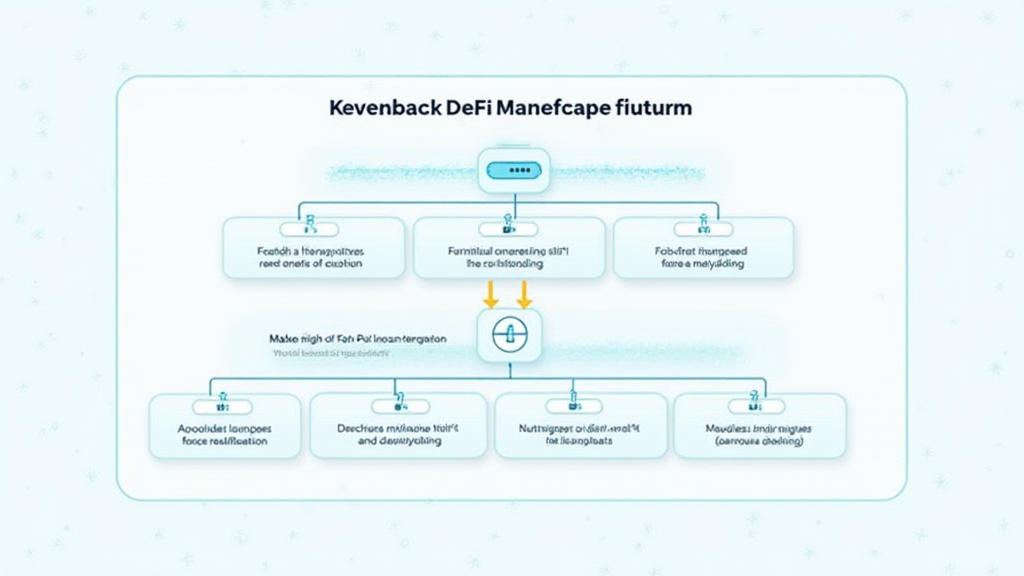

Understanding Liquidity Management in DeFi

Imagine a marketplace where vendors exchange products. Just as vendors need to keep enough stock to satisfy customers, DeFi platforms need liquidity to facilitate trading without significant price fluctuations. Vietnam DeFi liquidity management involves strategies to maintain this balance effectively.

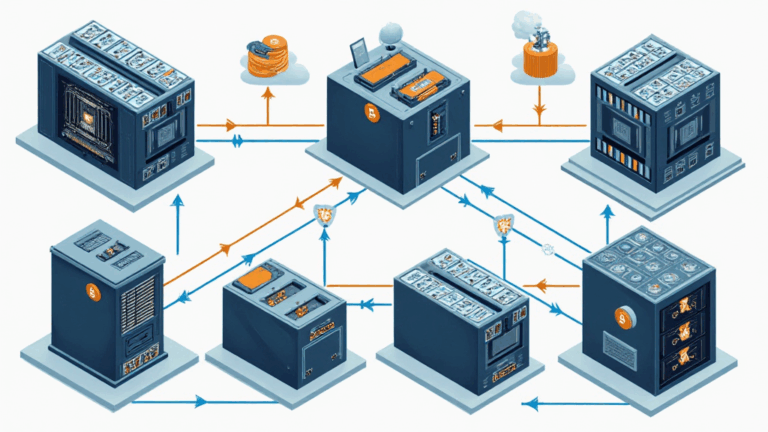

The Role of Cross-Chain Interoperability

Cross-chain interoperability in DeFi is like being able to buy fruits from different markets without having to travel. In Vietnam, implementing cross-chain solutions could improve liquidity across various platforms, allowing users to transact seamlessly. The challenge lies in ensuring security and efficiency.

Zero-Knowledge Proofs: Enhancing Privacy and Efficiency

Think of zero-knowledge proofs as a way to validate a transaction without revealing the specifics, just like showing your age without disclosing your birth date. In Vietnam’s DeFi landscape, utilizing zero-knowledge proofs can enhance privacy and streamline processes, making liquidity management more effective.

Future Trends: Regulatory Considerations in Vietnam

The upcoming regulations in Vietnam’s DeFi space, akin to a traffic signal guiding vehicles, will play a crucial role in shaping liquidity management. Understanding these trends is vital for users and developers alike as they navigate the future of DeFi.

In summary, effective Vietnam DeFi liquidity management is crucial as the industry evolves. To further understand these concepts and the tools available, download our comprehensive toolkit today.

View our DeFi resources and toolkit.

Disclaimer: This article does not constitute investment advice; consult local regulatory bodies such as the MAS or SEC before making decisions.

Tool suggestion: Using Ledger Nano X can reduce the risk of private key exposure by up to 70%.