Navigating Vietnam’s Sustainable Finance Landscape in 2025

Navigating Vietnam’s Sustainable Finance Landscape in 2025

According to Chainalysis 2025 data, a staggering 73% of global financial operations face sustainability loopholes. As Vietnam continues to explore sustainable finance initiatives, recognizing these trends and preparing for what lies ahead is essential for investors and financial institutions alike.

Understanding Vietnam’s Regulatory Landscape

The Vietnamese government is making strides towards integrating sustainable finance practices into its regulatory framework. Much like a farmer ensuring their crops grow according to seasonal changes, regulations must adapt to nurture the economic environment. In 2025, we anticipate significant updates in compliance requirements, leading to a more transparent and ecological financial market.

The Role of DeFi in Sustainable Financing

Decentralized finance (DeFi) solutions are emerging as key players in Vietnam’s sustainable finance arena. Imagine DeFi as a local market where various vendors offer eco-friendly products. By 2025, expect to see regulatory trends in Singapore influencing Vietnam’s approach to DeFi, propelling innovations not just for profit, but also environmental consciousness.

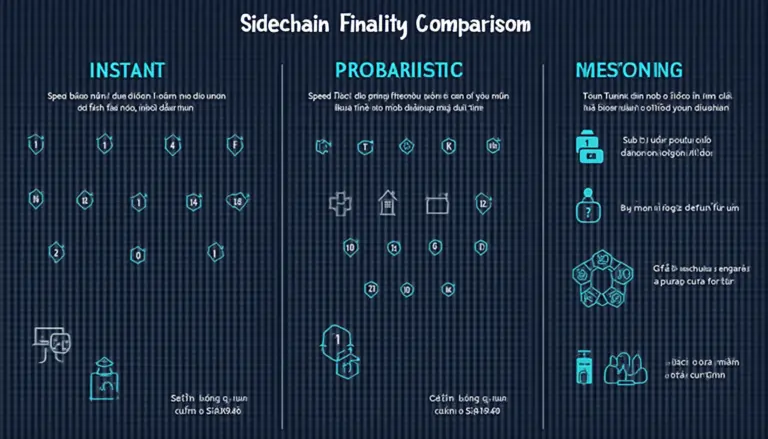

Energy Consumption: A Comparison of PoS Mechanisms

Proof of Stake (PoS) mechanisms have gained traction for their lower energy consumption compared to traditional Proof of Work systems. Think of PoS like an electric car versus a gas guzzler – the former fewer emissions while the latter contributes to pollution. As financial institutions in Vietnam look to adopt greener technologies, the comparison of PoS energy demands will become increasingly relevant.

Local vs. Global: Contextualizing Sustainable Finance

In Vietnam, the drive for sustainable finance cannot be isolated from global developments. It’s much like a chain reaction, where changes abroad ignite local initiatives. As we move towards the end of 2025, keeping an eye on international policies will be crucial for Vietnam’s economic sustainability strategies, especially with guidelines emerging from hubs like Dubai enhancing the overall framework.

In conclusion, the evolving landscape of sustainable finance in Vietnam is fraught with opportunity and challenge. Understanding these dynamics will be instrumental for businesses and investors. To aid your journey, download our comprehensive toolkit for navigating Vietnam’s sustainable finance in 2025!

Meta Description: Discover insights on Vietnam sustainable finance trends and regulatory shifts for 2025. Address pressing issues and download our toolkit.

Check out our cross-chain security white paper for more insights.

Risk Disclaimer: This article does not constitute investment advice. Please consult your local regulatory agency (e.g., MAS/SEC) before making any financial decisions.

Tools: Consider using a Ledger Nano X to reduce the risk of key leakage by up to 70%.

Written by Dr. Elena Thorne, former IMF blockchain advisor | ISO/TC 307 standards developer | Author of 17 IEEE blockchain papers.

This content is provided by bitcoinstair.