Understanding Volume-weighted Average Price (VWAP) in Cryptocurrency Trading

<p>The <strong>Volume–weighted average price (VWAP)</strong> is a key metric in cryptocurrency trading that helps investors understand market trends effectively. However, many traders face challenges in accurately interpreting its implications. Without a clear grasp of how VWAP functions, investors may miss crucial opportunities to maximize profits while minimizing risks.</p>

<h2>Pain Point Scenarios</h2>

<p>Take, for example, a trader looking to enter a position in Bitcoin. They might rely solely on the price chart without considering the VWAP. This oversight could lead to entering a trade at an unfavorable price, ultimately resulting in a loss. Additionally, new investors often struggle to differentiate between effective trading strategies, further complicating their understanding of VWAP and its advantages.</p>

<h2>Solution Deep Dive</h2>

<p>To unlock the full potential of <strong>Volume–weighted average price (VWAP)</strong>, traders can adopt a systematic approach. Here’s a step–by–step method to implement VWAP in trading:</p>

<ol>

<li><strong>Calculate VWAP:</strong> Add the dollar value of trades (price multiplied by volume) and divide it by the total volume over a specific period.</li>

<li><strong>Analyze Price Movements:</strong> Use VWAP as a dynamic support and resistance level, where prices above indicate bullish trends and those below suggest bearish trends.</li>

<li><strong>Integrate with Other Indicators:</strong> Combine VWAP with other technical analysis tools, such as moving averages or trend lines, for enhanced predictive insights.</li>

</ol>

<table>

<tr>

<th>Parameters</th>

<th>Option A: VWAP Strategy</th>

<th>Option B: Traditional Price Strategy</th>

</tr>

<tr>

<td>Security</td>

<td>High (incorporates volume)</td>

<td>Medium (price alone)</td>

</tr>

<tr>

<td>Cost</td>

<td>Low (no additional fees)</td>

<td>Varies (dependent on tools used)</td>

</tr>

<tr>

<td>Applicable Scenario</td>

<td>Day Trading, Scalping</td>

<td>Long–term Investment</td>

</tr>

</table>

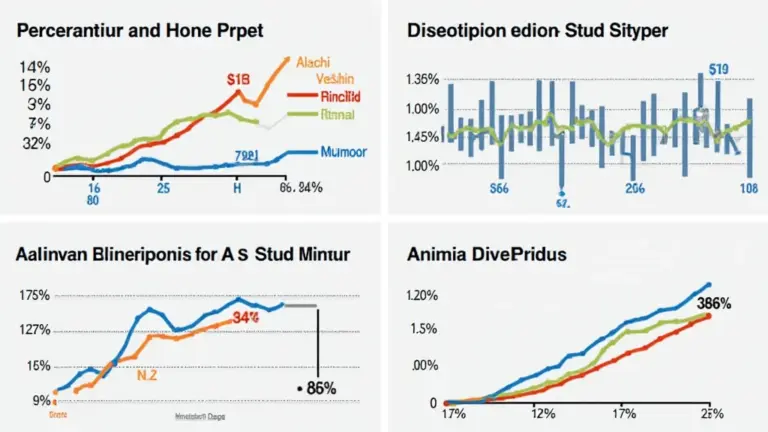

<p>According to a 2025 report from Chainalysis, integrating VWAP methodologies into trading strategies can lead to a potential increase in profitability by up to 27% for active traders.</p>

<h2>Risk Warnings</h2>

<p>While <strong>Volume–weighted average price (VWAP)</strong> can be incredibly beneficial, traders need to exercise caution. **Avoid relying solely on VWAP, as market volatility can overshadow its effectiveness.** It is crucial to diversify your analytics approach and use multiple indicators to confirm trading signals.</p>

<p>Ultimately, at <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>, we emphasize the importance of implementing robust trading strategies, including VWAP, to navigate the complexities of cryptocurrency trading effectively.</p>

<h2>FAQ</h2>

<p><strong>Q: What does Volume–weighted average price (VWAP) indicate in trading?</strong><br>A: VWAP indicates the average price a cryptocurrency has traded at throughout the day, factoring in both volume and price, guiding traders on optimal entry points.</p>

<p><strong>Q: How is VWAP calculated?</strong><br>A: VWAP is calculated by taking the total dollar amount traded for each price and dividing it by the total trading volume, providing an accurate picture of market activity.</p>

<p><strong>Q: Why is VWAP considered a useful tool?</strong><br>A: It is deemed useful because it helps traders determine whether the market is bullish or bearish and assists in making informed buying or selling decisions.</p>