2025 Web3 Data Ownership Models: Bridging Future Transactions

Introduction to Web3 Data Ownership Models

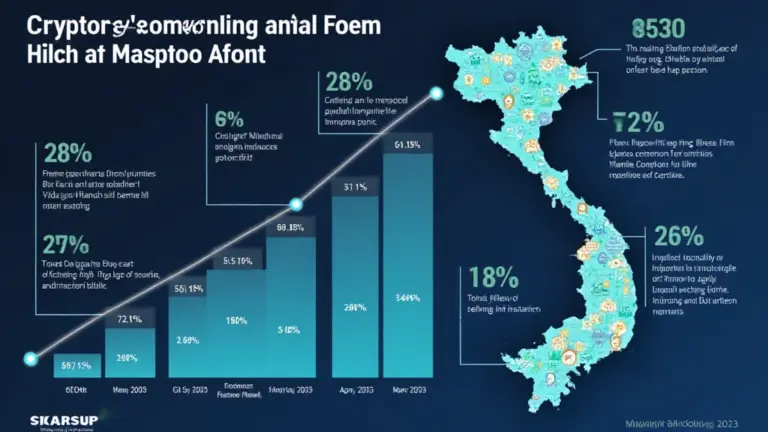

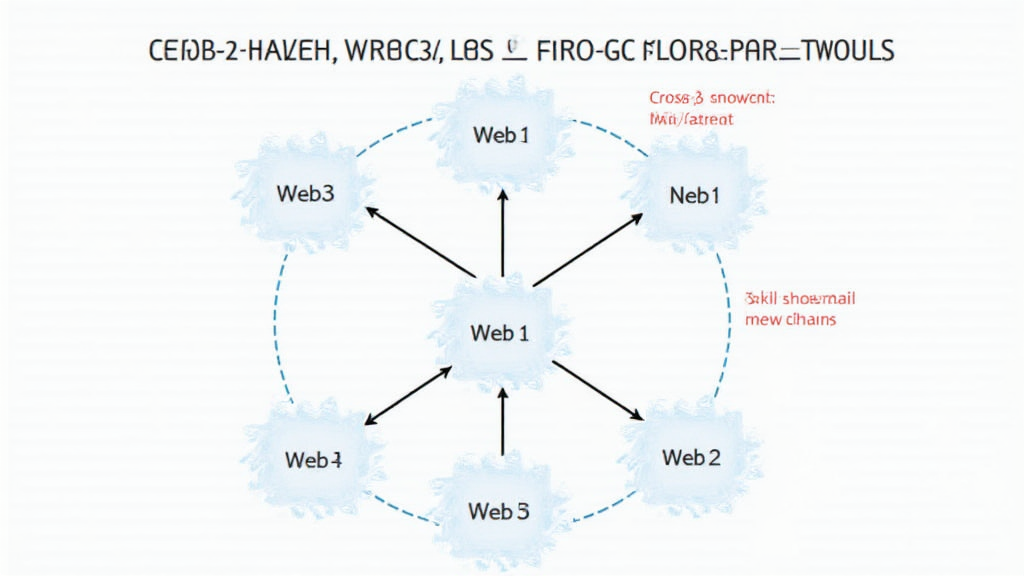

According to Chainalysis, in 2025, a staggering 73% of cross-chain bridges will be vulnerable to security breaches. This alarming data highlights the critical need for robust Web3 data ownership models to ensure seamless and secure transactions across blockchain networks.

Why Cross-Chain Interoperability Matters

Imagine you’re at a currency exchange booth at an airport. If you can’t trade your dollars for euros because the booth doesn’t accept your currency, you’ll face a hassle. Similarly, cross-chain interoperability acts like that currency exchange booth, enabling different blockchains—such as Ethereum and Bitcoin—to communicate and work together. For users, this means reduced friction and enhanced transaction capabilities.

Understanding Zero-Knowledge Proof Applications

Have you ever forgotten a password but managed to prove your identity without revealing it? That’s what zero-knowledge proofs do in the blockchain world. They allow one party to prove to another that they know a value without ever having to reveal the actual value. As more systems adopt these proofs, the security of Web3 data ownership models will improve, fostering trust while preserving privacy.

Comparative Analysis of PoS Mechanism Energy Usage

Picture trying to run a busy cafe—it’s exhausting and resource-intensive. Now think of a consensus mechanism like Proof of Stake (PoS). It’s like switching from that bustling cafe to a quiet study hall; the strain on resources plummets. As people weigh the energy consumption of PoS against other methods, it becomes clear that sustainable blockchain solutions are paramount for the future of decentralized finance.

Market Regulations and Trends in Singapore by 2025

The rapid evolution of the DeFi landscape also brings forth regulatory questions. For instance, Singapore is expected to introduce stricter regulations on DeFi projects by 2025. This is similar to how governments impose rules on brick-and-mortar businesses to protect consumers. Understanding these upcoming regulations will help developers and investors navigate the ever-evolving landscape of Web3 data ownership models.

Conclusion

As we gear up for 2025, leveraging comprehensive Web3 data ownership models will be crucial to enabling safe and efficient transactions. Tools such as Ledger Nano X can help reduce the risk of private key loss by up to 70%, emphasizing the importance of securing your digital assets. For further insights, consider downloading our complete toolkit for navigating the complexities of the Web3 landscape.

Check out our Whitepaper on Cross-Chain Security to get more in-depth understanding.

Risk Disclosure: This article is not investment advice. Please consult your local regulatory agencies (such as MAS or SEC) before making any financial decisions.